Performance

Benchmark-Beating Returns Across Timeframes

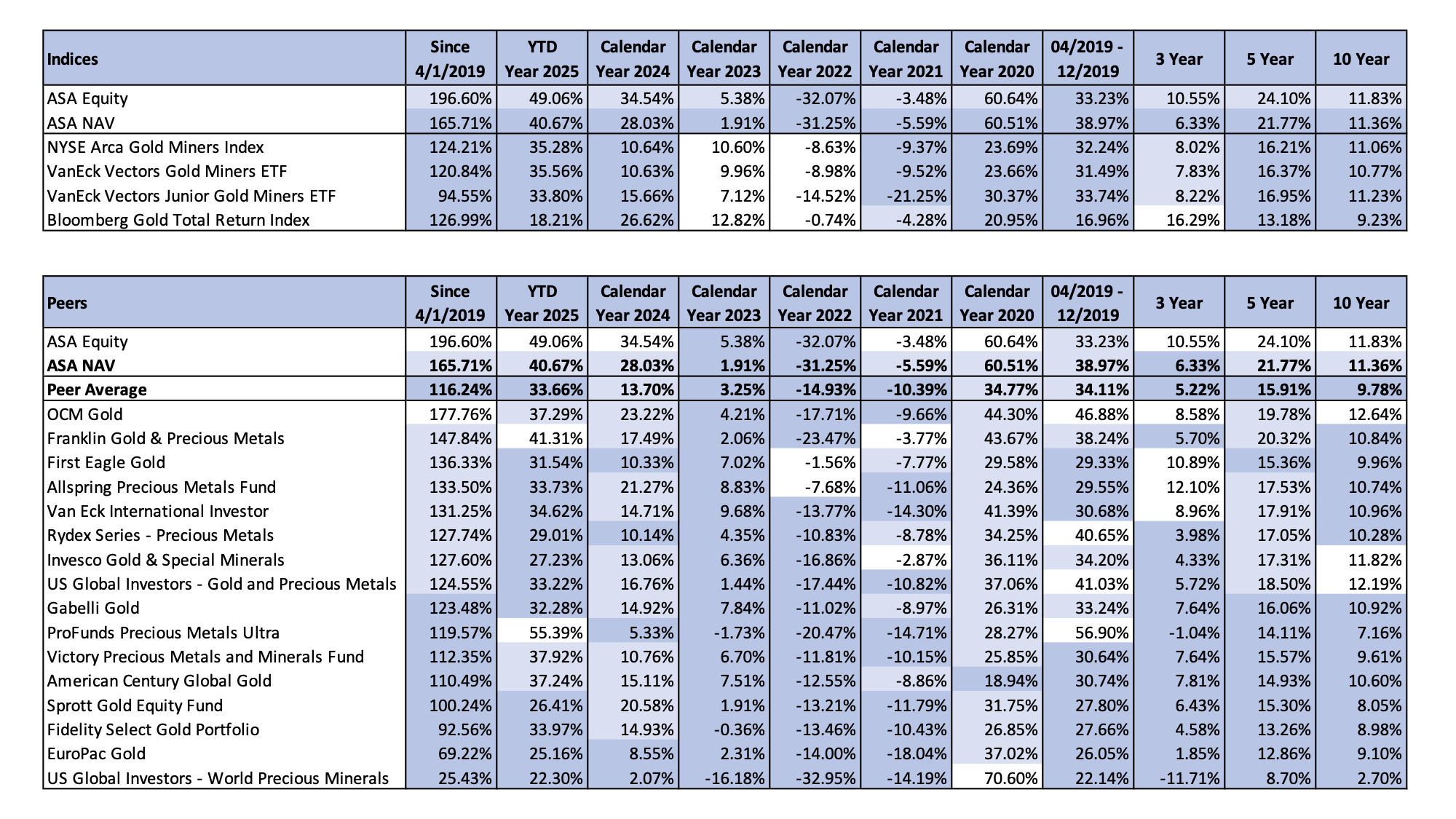

ASA has delivered strong, risk-adjusted performance. The Fund ranks at or near the top of publicly available gold and precious metals strategies over 1-, 2-, 5-, and 6-year periods (as of March 31, 2025).

For example, ASA’s five-year NAV and share price returns through March 31, 2025, both ranked first among its peer group.

Since April 2019, when Peter Maletis became portfolio manager, ASA has outperformed mining indices, gold, and peer funds across multiple timeframes. The Fund’s approach—focused on disciplined stock selection, long-term positioning, and access to less liquid mining equities—has delivered strong returns even through sector volatility.

Why It Matters:

ASA’s performance underscores the value of its structure and mandate. These returns reflect the outcomes of ASA’s current strategy—and offer important context as shareholders evaluate the fund’s future.

Data as of March 31, 2025. Source: Bloomberg

The 10-year return includes 4 3⁄4 years of the previous portfolio management team.

Peter Maletis began managing ASA on April 1, 2019. On April 12, 2019, ASA shareholders approved Merk Investments as the Fund’s investment manager. Jamie Holman joined the ASA portfolio management team on April 1, 2022.

Past performance is no guarantee of future results. Current performance may differ from that shown. ASA concentrates in the gold and precious minerals sector. This sector may be more volatile than other industries and may be affected by movements in commodity prices triggered by international monetary and political developments. The Company is a non-diversified fund and, as such, may invest in fewer investments. ASA Gold and Precious Metals Limited may invest in smaller- sized companies that may be more volatile and less liquid than larger, more-established companies. Investments in foreign securities, especially those in the emerging markets, may involve increased risk as well as exposure to currency fluctuations. Shares of closed-end funds frequently trade at a discount to their net asset value.

Saba is seeking board control through a special meeting to add a fifth director. Shareholders are encouraged to vote NO to protect ASA’s mandate.

This is a proxy solicitation by shareholder Axel Merk, made solely in his individual capacity. It is not part of a solicitation by ASA Gold and Precious Metals Limited, or any other shareholder, or group.

SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. Shareholders may obtain the documents free of charge at the SEC's website, http://www.sec.gov.

PLEASE READ THE PROXY STATEMENT CAREFULLY BEFORE MAKING A DECISION CONCERNING THE PROPOSALS.

The information presented on this website reflects the views and opinions of Axel Merk and is provided solely for educational and informational purposes. It does not constitute investment, legal, financial, or tax advice. You should consult your own advisors for guidance specific to your circumstances.

This site and its content have not been approved by ASA Gold & Precious Metals Ltd. (the “Company”). The Company concentrates its investments in the gold and precious minerals sector, which may be more volatile than other industries and influenced by changes in commodity prices driven by international economic and political developments. The Company is a non-diversified fund, which may result in higher risk through reduced portfolio diversification. It may also invest in smaller-sized and foreign companies, which may be more volatile, less liquid, and subject to additional risks, including currency fluctuations. Shares of closed-end funds like ASA frequently trade at a discount to net asset value.

This website may include forward-looking statements that reflect the current expectations, estimates, beliefs, and projections of Axel Merk. These statements are inherently subject to risks and uncertainties, many of which are beyond the control of the author. Actual outcomes may differ materially from those discussed. Forward-looking statements can often be identified by words such as “believe,” “expect,” “intend,” “may,” “will,” “should,” or similar expressions. These statements speak only as of the date made, and there is no obligation to update or revise them in light of future developments.

Nothing on this website constitutes an offer to sell, or a solicitation of an offer to buy, any securities.

Certain links may direct users to third-party websites or filings with the U.S. Securities and Exchange Commission (SEC). These materials are provided solely for convenience and informational purposes and are not incorporated by reference into any proxy materials. No responsibility is taken for the accuracy or content of third-party sources.